Nevada Series Limited Liability Companies (LLCs)

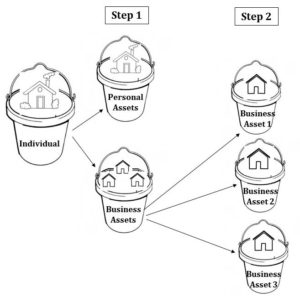

As discussed in my prior post on asset protection, at Incline Law Group we are always looking for ways to protect our clients’ assets by achieving two goals 1) separating business assets from personal ownership and 2) separating business assets from each other by avoiding common ownership. There are many ways to do this and the best way depends on the type of assets, the risk level associated with your assets, financing issues, personal preference, taxes and many other factors.

For real estate investment, such as ownership of a number of income properties, a Nevada Series Limited Liability Companies can be a really great entity structure to maximize asset protection and minimize administrative costs. Series LLCs are not for everyone, so carefully analyzing the benefits to your business assets with your attorney and CPA is extremely important.

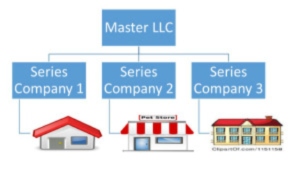

A Series LLC looks similar to a parent company/subsidiary sort of structure. A master company is filed with the Nevada  Secretary of State, like any other LLC, but with an election to be a Series LLC. The creation of any number of series companies is authorized in the Series LLC governing documents. When a new series company is needed, it can be formed internally and is not registered with the Secretary of State, thus minimizing filing fees. While each series company may have its own tax ID number, a single tax return may be filed which can maximize tax benefits of profit and loss sharing across the series companies.

Secretary of State, like any other LLC, but with an election to be a Series LLC. The creation of any number of series companies is authorized in the Series LLC governing documents. When a new series company is needed, it can be formed internally and is not registered with the Secretary of State, thus minimizing filing fees. While each series company may have its own tax ID number, a single tax return may be filed which can maximize tax benefits of profit and loss sharing across the series companies.

This type of entity structure can be a great fit for real estate holdings. For example, if I own 5 rental properties, I can put each property into a series company. I am able to save licensing and filing fees, as well as potentially file a single tax return, but at the same time, each of those series companies is treated as a distinct and separate LLC (so long as I follow all applicable statutory, financial and governance rules). Therefore, I have achieved a great deal of asset protection while minimizing costs.

Again, Series LLCs are not for everyone. They do require extra TLC when it comes to banking, financials and bookkeeping. They also have limited application if your assets are located in another state, such as California. But if, after careful investigation, it looks like a Series LLC may fit your needs, it is a structure that can be a fantastic tool for asset protection.