Asset Protection – Common Misconceptions and the Bucket Theory

It is quite common for clients to tell me that they thought their standard family revocable grantor trust would serve to protect assets from creditors. This is a very common misconception. Your standard revocable family trust does not in fact provide any asset protection. There are certain types of trusts that can provide assert protection, such as Nevada irrevocable asset protection trusts. However, it is not always necessary to utilize these very advanced estate planning techniques for the average person to protect assets from creditors.

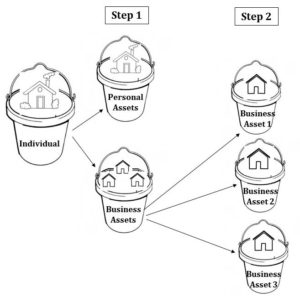

When seeking to protect assets we seek to achieve two goals:

- separate your business assets from your personal assets.

- separate your business assets from other business assets.

For example, if you own a primary residence and two office buildings, your first consideration might be putting the office buildings into an entity (LLC, Series LLC, Corporation or the like) and removing them from being titled under your individual name. The second consideration would be to separate the assets from each other by putting each office building into separate entities.

Why is this type of structure recommended? Because if everything is in your individual name and one of the tenants sues for a slip and fall, and obtains a judgment against you, it will be a personal judgment and your personal assets may be subject to that judgment, including your home. If all of your assets are in your name, you have created one big bucket of aggregated value for a judgment creditor to dip into.

However, if the business assets are held in an entity structure, you are starting to create multiple buckets which hold fewer assets and less value. The tenant, in this case will be limited to seeking a judgment against the business at which s/he fell and recover only against its assets, which will no longer include your personal home. Further, if we have taken the extra step of separating the business assets from each other, then we are again creating more buckets and minimizing the value that is available for satisfaction of the judgment in each bucket.

Every client’s needs, level of risk and level of risk tolerance are different. Additionally there may be tax and other considerations when looking at entity structures. Corporate formalities and relevant laws must be adhered to in any entity structure to maintain the protections they can afford. It is important to discuss all of these issues with your legal counsel and CPA before forming new entities and transferring assets.

You spent a great deal of time and effort to earn and grow your assets. A well thought out asset protection plan is important to safekeeping them.